Introduction

You must have heard about how bad cryptocurrency is because it’s unpredictably versatile, and unbacked by physical funds. I have heard it be referred to as “worthless”, or “as valuable as a banana.” Traditionally, any market coin is backed by a physical supply of wealth with some government control which is exactly what Brockchain finance isn’t.

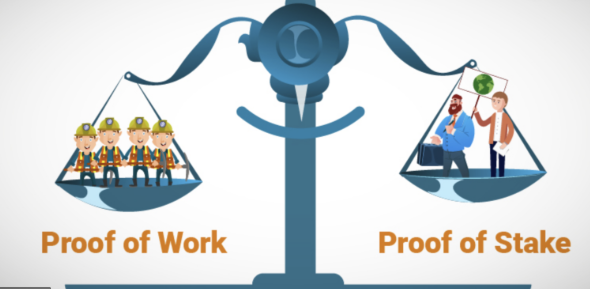

Cryptocurrency works because the need for supply and demand allows the virtual coins to generate a value that can become as valuable as any physically-backed coin. Part of knowing why a coin works are by knowing what creates a coin. This is where Proof of Work and Proof of Stake play an essential role in maintaining their Crypto Coins.

Countries across the planet use a major governing body to decide what money should be printed, what money should be destroyed, and what money should be held to stabilize the economy. The blockchain’s cryptocurrency market sort of does the same thing. Depending on the coin, the markets tend to build up relying on one of two factors: the number of investors holding a coin, or the number of coins being “created” by miners. These two factors build what makes up a cryptocurrency possible.

Proof of Work

The proof of work is a protocol that has the main objective of deterring cyber-attacks, such as a distributed denial-of-service attack (DoS) that aims to deplete the resources of a computer system by sending multiple false requests.

A distributed and untrusted consensus system means that if you want to send and/or receive money from someone, you don’t need to rely on third-party services. When you use traditional payment methods, you must rely on a third party to configure your transaction (for example, Visa, Mastercard, PayPal, banks). They maintain their private record that stores the transaction history and balances of each account.

A common example to better explain this behavior is as follows: if Bob sent Alice $20, the service of a trusted third party would debit Bob’s account and Alice’s accounts, so both must trust that this third party should do the right thing. This is necessary so there is no double-spending, meaning the $20 Bob sent will sync with his account and Alice’s account.

With bitcoin and some other digital currencies, everyone has a copy of the ledger (blockchain), so nobody must trust third parties because anyone can directly verify written information.

How does it work?

A great many individuals use Bitcoin, Ethereum and different blockchains that utilization the Proof of Work model. In all innovations, the procedure is the equivalent in the other Work Proof square chains.

Bitcoin exchanges take 10 minutes before they are confirmed as substantial. Miners at regular intervals, “mine” blocks of various exchanges within a blockchain to confirm the transactions within. Each block contains various exchanges inside it, which must be freely confirmed. For the Bitcoin system to accomplish this without outsiders, somebody must utilize its computational capacity to unravel a cryptographic calculation, otherwise called Proof of Work. When this is accomplished, not exclusively is the exchange set apart as legitimate, however, it is likewise presented on the open blockchain for all to see.

You might be asking why somebody would purchase equipment and devour a ton of power just to help affirm Bitcoin exchanges. All things considered, the straightforward answer is that individuals are remunerated with extra Bitcoin (or the Cryptocurrency Proof of Work is affirming) for their endeavors. Nowadays, small miners go after coins that are more worth their time like Litecoin or Ravencoin since the Bitcoin mining operations have been taken over by larger, more centralized computers owned by large companies. BTC.com is said to produce 29.6% of all mining production in its mining pool. That number may seem on the lower side, but if you consider how many machines are participating in this process, this chunk is massive.

The significant thing is to comprehend that not every person gets a reward. Many individual gadgets contend to turn into the first to settle the cryptographic calculation. Whoever arrives first wins the reward.

Applications of Proof of Work

The most famous PoW application is Bitcoin. It was Bitcoin who laid the foundation for this sort of agreement. This calculation enables you to change the multifaceted nature of a riddle dependent on the absolute intensity of the system. The normal square development time is 10 minutes. Bitcoin-based cryptographic forms of money, for example, Litecoin, have a comparative framework.

Another incredible task with PoW is Ethereum. Since right around three of the four activities are executed on the Ethereum stage, it is protected to state that most Blockchain applications utilize the PoW accord model.

Advantages of Proof of Work

There are several important benefits to Proof of Work systems. First, they are an excellent way to deter spammers. If a moderate amount of work is required for each process (for example, sending an email), then most spammers would not have enough computing power to send any unsolicited emails. Or, if a spammer had enough computing power to send many emails, the financial costs of this processing power (that is, buying the hardware and paying for electricity) would probably exceed the profits obtained from spam. This is how a Proof of Work system discourages spam and other forms of malicious behavior.

Furthermore, Proof of Work frameworks can be utilized to give security to a whole system. This is the principal advantage for blockchains that utilization the Proof of Work agreement system. If enough hubs (PCs or machines committed to digital currency mining) are contending to locate a particular arrangement, at that point the computational power expected to command and control a system gets unattainable for a solitary terrible entertainer or even a solitary gathering of awful on-screen characters.

Proof of Stake

Proof of stake is a substitute strategy to endorse trades based and achieve the spreading understanding. The expectation is what might be compared to the confirmation of work, yet the technique to land at the goal is extremely one of a kind. Unlike the affirmation-of-Work, where the computation rewards excavators who deal with confirming trades and mining blocks, with the check of stake, the producer of another square is picked in a deterministic way: its wealth. The act of holding the coin is described as stake. In the PoS structure, rewards are given to those who “stake” the coin.

How it Works

The Participation Test model uses an alternate procedure to affirm exchanges and arrive at an agreement. The framework still uses a cryptographic calculation; however, the target of the instrument is unique. While Proof of Work remunerates its digger for fathoming complex conditions, in Proof of Stake, the person who makes the following square depends on the amount they have to “wager.” To disentangle things for you, the wager depends on the measure of coins the individual has for the exact blockchain he is attempting to remove. Be that as it may, people don’t undermine. Rather, they are designated “forgers,” because there is no square reward. While Bitcoin, which utilizes the Proof of Work model, gives a square reward each time another square is confirmed, the individuals who add to the Proof of Participation framework acquire the exchange expense.

Applications of Proof of Stake

Stakeholder test blockchain conventions are getting one of the most encouraging options in contrast to vitality confirmation work test conventions. Be that as it may, an especially basic risk in the design of PoS is the notable long-run assaults brought about by the spillage of mystery keys. An opponent may endeavor to control/bargain accounts that have generous cooperation previously, to twofold spend or eradicate past exchanges, abusing the property of basic blockchain ingenuity. Culpable marks give an agreeable answer for the handy stacking test blockchain impervious to LRSL assault, albeit existing developments are not effective enough for functional usage.

Advantages of Proof of Stake

Because of the absence of high-power utilization, there isn’t such a great amount of need to issue the same number of new coins to rouse members to keep taking an interest in the system. Hypothetically, it might even be conceivable to have a negative net issuance, where a portion of the exchange expenses are wearing out and in this way, supply diminishes after some time.

Stake testing opens the entryway to a more extensive scope of strategies that utilization the plan of hypothetical game systems to more likely dishearten unified cartels from shaping and, on the off chance that they do, from acting negatively to the system.

References:

1) https://www.buybitcoinworldwide.com/mining/pools/ – The Biggest Mining Pools, Jordan Tuwiner. Last updated January 29, 2019